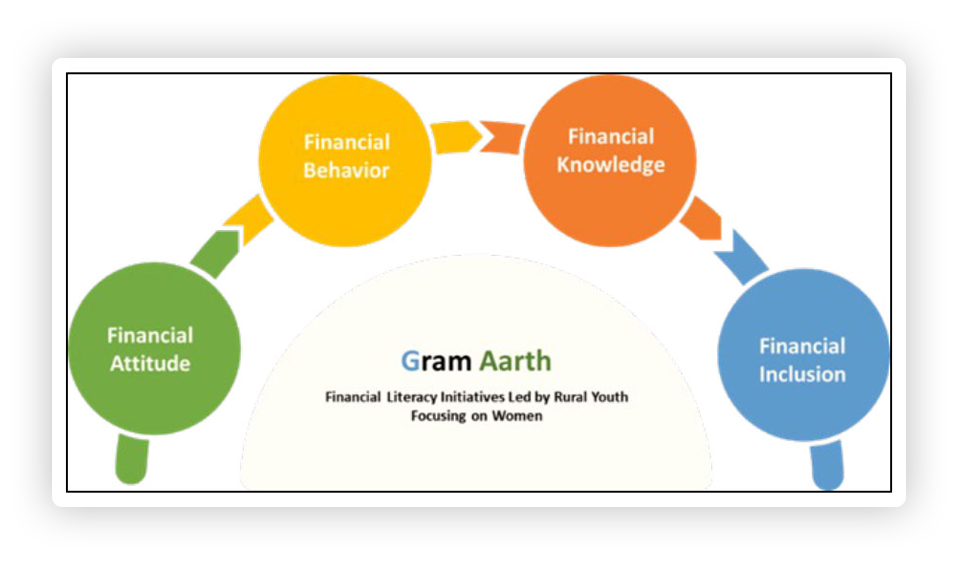

ram means village/community and Arth means finance. The name has been given by MelJol’s Aflatoun Young Leaders who are the torch bearers of MelJol endeavour. GramArth is a comprehensive program aimed at enhancing financial inclusion and education in communities. The program recognizes the significant gap in financial knowledge, attitudes, and behaviours, particularly in economically vulnerable areas. Through a multi-faceted approach, GramArth seeks to empower children, youth, women and significant others from communities by enhancing financial knowledge and skills that will empower them in making informed decisions about money matters and financial products, ultimately improving their financial well-being.

The Reserve Bank of India’s (RBI) recent survey on Financial Knowledge, attitudes and behaviour, highlights a significant gap in financial literacy across the population. Following were the findings :

Financial Knowledge

Only 32% of respondents were able to achieve a score of at least 3 out of 10 on a basic financial knowledge test (Reserve Bank of India, 2024) indicating a lack of understanding of fundamental financial concepts, exposing them to financial risks, particularly in economically vulnerable communities.

Financial Attitude

Only 28% of respondents scored 2 out of 10 on the financial attitude scale, reflecting a generally pessimistic or imprudent approach towards money management (Reserve Bank of India, 2024).

Financial Behaviour

Although over 56% of respondents recognized the importance of long-term financial planning, many rural residents lack the resources and knowledge to effectively plan for their financial futures. This underscores the need for comprehensive financial education and support services in rural communities to break free from the cycle of poverty and achieve sustainable economic growth.

Project Goals

Enhance the financial knowledge of rural communities to empower them in making informed decisions about money matters and financial products, ultimately improving their financial well-being.

Gram Arth intends to create financially educated and financially inclusive villages and communities over a period of 3 to 5 years.

Work with children – Build a strong foundation of life skills and financial education in the future citizens and equip them with the knowledge and skills they need to navigate their financial futures successfully.

Work with youth – They are contributing to the economy but not benefiting from the increased or regular income due to bad financial decision making abilities. Meljol has also observed that youngsters often fall into certain bad financial practices, which can have long-term implications. Certain bad financial practices seen are Living Beyond Means, Ignoring Savings, Overreliance on credit, impulse buying, no vision for future (financial security) and short- term focus is hampering the advantage of education and employment generated pushing them and their families in cycle of debt and no movement out of the poverty cycle.

Work with women – Given women and mothers a powerful tool i.e. financial education it will not just help women achieve financial security, independence, and the ability to contribute positively to their families and communities.